Asset Allocation is the key to securing your future retirement income.

What is Asset Allocation?

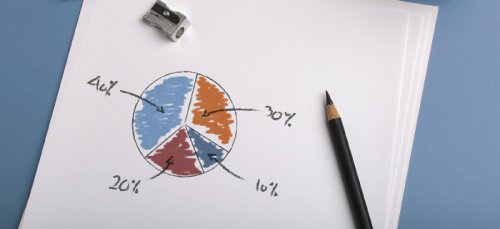

We use this term to describe the amounts of money allocated to the different types of investment available in an investment portfolio. Broadly, these fall into three categories; these being company shares, real-estate, and interest-bearing deposits.

As you would expect, returns on these different investments vary over time. For example, over the past few years, Australian industrial shares have paid higher investment income than bank deposits and property rental income.

Many economic factors determine which investments perform better over different time periods. It is vital hold your funds in the right assets at the right time; that is, to have the right Asset Allocation.

The vast majority of SuperFunds have a 'default' asset allocation; this being how your fund is invested unless you give your fund manager explicit instructions to the contrary. (This default allocation is now known as the 'MySuper' option.)

Generally, the asset allocation of a default/MySuper option does not vary over time. Clearly, therefore, it stands to reason that there will always be some proportion of such a fund which is performing less than optimally. This weakness will ultimately be reflected in a less-than-satisfactory pension-income when you retire.

The Solution?

A competent Financial Adviser will inform and guide you as to how your funds should be allocated, and periodically adjusted, according to economic conditions, as they change over time.

Appropriate Asset Allocation - and its ongoing management - is the key to ensuring you get the very best performance out of your SuperFunds.

And that means securing the best pension-income by the time you retire.

Far better than leaving it to MySuper - and chance.